What you know about Monopsony

It is a market which is totally

reverses the monopoly market. In this market, there is only one buyer available

for any goods and services. Not a single buyer interested in a particular goods

and services. For example, may be the consumer in the organized manners or any

government which ban other one or some-one who make a habit for a particular

thing.

In other words, we can say that it

is a market where only one buyer available to buy any-thing without any

competition & also there is a ban for new buyer to inter into the market.

Price will be fixing just similar to the monopoly market. In monopsony, adjust

the buyer behaviour in a manner where its marginal utility is equal to marginal

cost so that he maximum his marginal utility.

|

| Monopsony market |

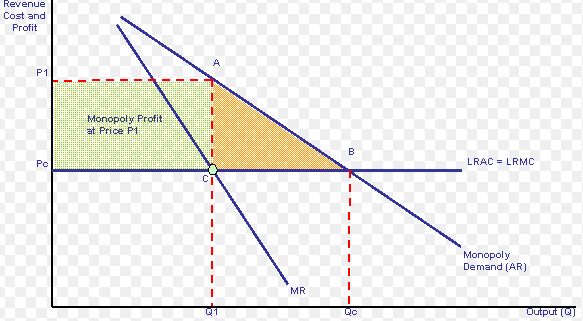

A monopsony set there equilibrium on

“X” where MU=MC, he want to buy “OY” quantity at “BY” price. In this way, a

monopsony set a marginal utility “ABXC”.