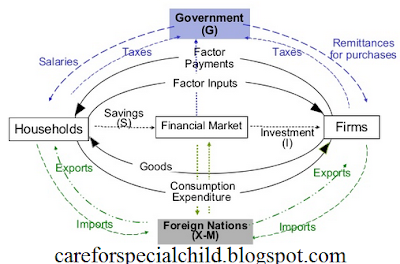

Income

& its Circular Flow

It is a basic concept about income

that money always is in a rotation from one person to another in the form of

income & expenditure. There is lot of activity like saving, tax, government

exp, investment and import or export, if we add these figure then we are able

to find out our National Income from different – 2 method like – income method

or expenditure method and we know that our national income is always be equal

to national expenditure.

Income flow between business &

house hold sector –

We start it from a basic concept

that our economic start from two sides – one is house hold and second is

business.

|

| Flow of Money |

First side, house hold – This side of the economic hold

all the production factor like land, capital or man power etc. house hold use

these production factor in production process and get rent on land, interest on

capital and wages or salaries on manpower etc. so these sector sale their

services and earn income. This side has the consumption and buys all the goods

& services which are produces.

Second side, business sector – These sectors have the idea and

produce the goods & services and sale these production to the house hold

and earn money. Or other way, we can say that the house-hold is the entire

market for business sector. They buy the entire production factor from house

hold and pay them (rent, interest, wages or salaries) for this. So, there is a

continue flow of money from one another at every time.

Assumption –

ü

House-hold

spent all his income on goods & services

ü

Total

production is always be equal to total sale or consumption

ü

There

is no saving by business sector